The accounting world is expected to transform in 2026, driven by key trends such as technology, big data, and an emphasis on green accounting. To remain competitive in the coming years, you will be required to acquire technical skills and strengthen your soft skills.

According to Research & Markets, the global accounting service market is projected to increase to $1,009.51 billion by 2026, growing at a rate of 11.4%. From 2026 onward, the market is expected to expand at a CAGR of 11.5%, reaching $1,738.70 billion by 2031.

Staying informed about such developments and investing in professional growth through Edstellar’s training resources will be essential for remaining relevant in the coming years. Let's look at the six most important skills that will help you stay relevant in 2026 and beyond!

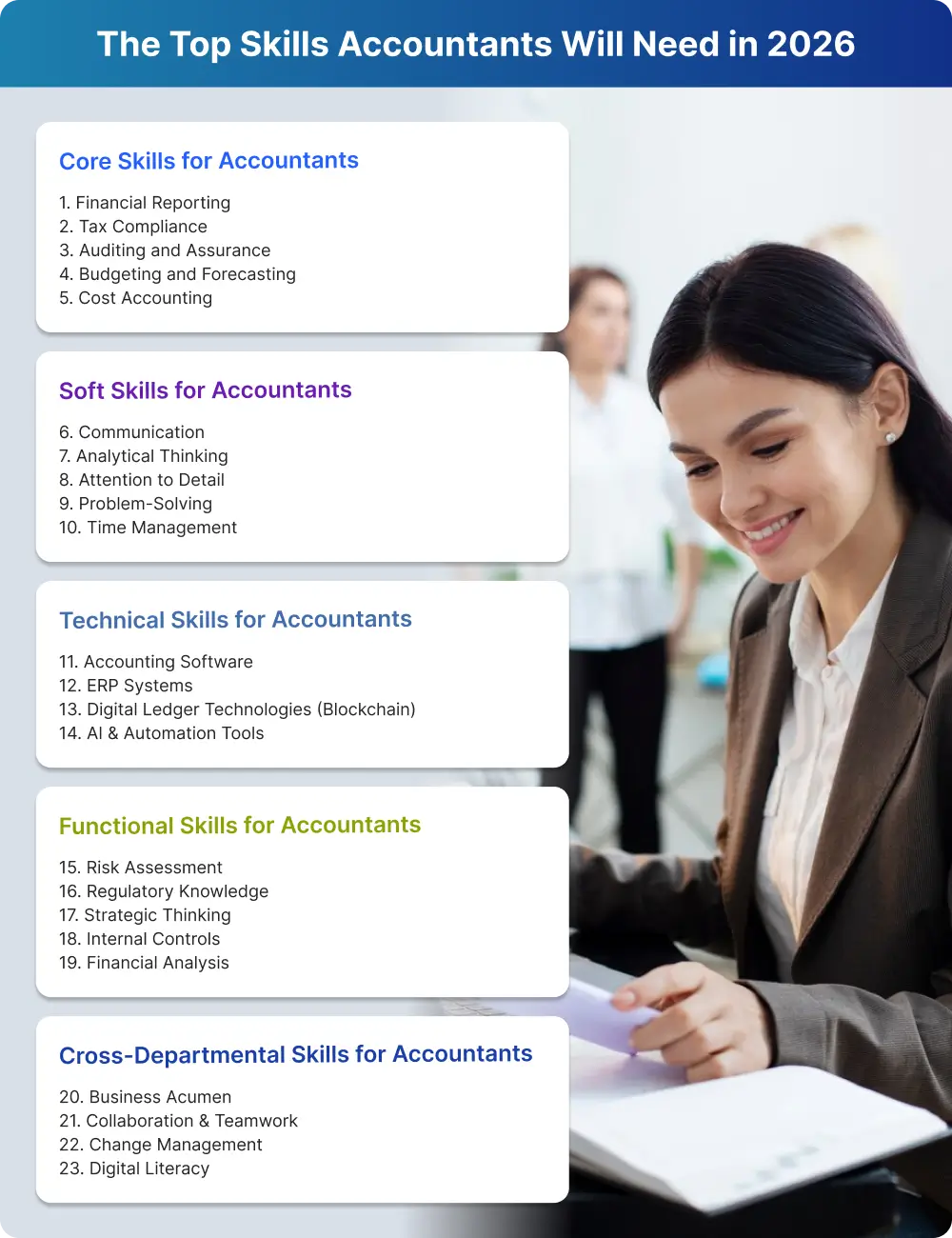

The Top Skills Accountants Will Need in 2026

Core Skills for Accountants

Core accounting skills encompass the essential technical competencies that ensure the integrity of financial processes, regulatory compliance, and data accuracy. The skills of an accountant are essential for tasks like preparing financial statements, managing audits, ensuring tax compliance, and optimizing budgeting and cost control. They form the foundation of an accountant’s role, enabling professionals to deliver reliable financial insights and guide decision-making at every organizational level.

In 2026, the role of accountants will be defined by their ability to adapt to a rapidly evolving business environment. With increased regulatory scrutiny, expanding global operations, and the integration of advanced technologies such as AI and blockchain, the demand for precision and compliance has never been higher. Accounting skills go beyond meeting statutory requirements; they are crucial for leveraging financial data to uncover opportunities, mitigate risks, and shape effective business strategies.

Accountants who excel in these core areas will meet growing role expectations while building stakeholder trust and strengthening organizational resilience in the digital age.

1. Financial Reporting

Financial reporting involves preparing, analyzing, and presenting financial statements in compliance with international standards such as IFRS or GAAP. This skill is crucial for ensuring accuracy and transparency in financial documentation. Accurate documentation forms the basis for decision-making by both internal management and external stakeholders, such as investors and regulatory bodies. Accountants must excel at interpreting financial data to identify trends and assess organizational performance.

2. Tax Compliance

Tax compliance demands a deep understanding of complex tax regulations, such as cross-border taxation, digital tax frameworks, and country-specific obligations. Accountants must stay updated on evolving policies to ensure timely and accurate tax submissions, minimize liabilities, and avoid penalties. Additionally, being proficient in digital tax reporting systems is crucial for automating filings and efficiently managing tax audits.

3. Auditing and Assurance

Auditing and assurance skills are critical for verifying the accuracy of financial records and ensuring compliance with legal and regulatory frameworks. Accountants must conduct thorough internal and external audits, identify gaps in controls, and implement corrective actions. Proficiency in digital auditing tools, such as data analytics platforms like EY Helix, enhances efficiency and reduces risks.

4. Budgeting and Forecasting

Budgeting and forecasting involve creating detailed financial plans and predicting future financial trends based on historical data and market analysis. Accountants must develop budgets that align with organizational goals and use forecasting tools to anticipate challenges and opportunities. For example, implementing scenario-based forecasting enables organizations to prepare for potential economic shifts and adjust strategies in real-time, ensuring financial stability and growth.

5. Cost Accounting

Cost accounting focuses on analyzing and controlling costs associated with business operations to enhance profitability. Accountants have to track cost drivers, allocate resources effectively, and identify areas for cost optimization. Accurate cost accounting also supports the development of competitive pricing strategies that align with market demands.

Soft Skills for Accountants

Soft skills are the interpersonal and cognitive abilities that complement an accountant’s technical expertise, enabling effective collaboration, decision-making, and adaptability. In a role that demands precision and interaction with diverse stakeholders, these skills are critical for interpreting financial data, presenting insights, and managing dynamic work environments.

Developing these skills for accounting empowers professionals to communicate financial insights effectively, address complex challenges efficiently, and foster trust with stakeholders.

6. Communication

Accountants must excel in both written and verbal communication to effectively convey complex financial information to non-financial stakeholders. Whether drafting reports, presenting data-driven insights, or engaging in collaborative discussions, clear communication ensures alignment and informed decision-making.

With the rise of virtual meetings and global teams, proficiency in digital communication tools like Microsoft Teams, Zoom, and Slack is essential for accountants to maintain effective collaboration and accurate financial reporting.

7. Analytical Thinking

Analytical thinking enables accountants to interpret financial data critically, identify trends, and draw meaningful conclusions. This skill is indispensable for detecting anomalies, evaluating risks, and making data-driven decisions. As predictive analytics and machine learning become integral to accounting, strong analytical thinking will differentiate professionals capable of deriving strategic insights.

8. Attention to Detail

Accuracy is the cornerstone of accounting, making attention to detail a non-negotiable skill. Accountants must meticulously review financial records, identify discrepancies, and ensure compliance with complex regulations. In an era of automation, this skill remains vital for overseeing and verifying the accuracy of system-generated data.

9. Problem-Solving

Accountants frequently encounter challenges, from resolving financial discrepancies to navigating regulatory complexities. Strong problem-solving skills enable them to analyze issues methodically, propose effective solutions, and implement corrective actions. With the increasing reliance on technology, accountants must also address tech-related hurdles, such as integrating new software with existing systems, making problem-solving an indispensable skill for accountants.

10. Time Management

Effective time management is a cornerstone skill for accountants, who often juggle competing priorities and tight deadlines. With responsibilities ranging from preparing financial statements and managing tax filings to conducting audits and closing accounts, accountants must excel at organizing their schedules to ensure accuracy and efficiency. This requires the ability to assess the urgency and complexity of tasks, allocate appropriate resources, and adjust plans as unexpected challenges arise.

Technical Skills for Accountants

Technical skills for accountants include advanced expertise in essential tools, platforms, and methodologies for optimizing financial management and analysis. This involves proficiency in accounting software like QuickBooks and Xero, mastery of ERP systems such as SAP and Oracle NetSuite, and an understanding of emerging technologies like blockchain and AI-powered automation tools. Skills in accounting empower professionals to effectively handle transactional data, navigate complex financial regulations, and deliver actionable insights that support strategic decision-making and organizational growth.

The following accounting technical skills enable professionals to adapt to evolving financial landscapes and meet the demands of a technology-driven industry.

11. Accounting Software

Proficiency in accounting software like QuickBooks, Xero, and Sage is critical for streamlining tasks such as invoice processing, expense tracking, and financial reporting. Advanced use of cloud-based platforms like QuickBooks Online allows accountants to collaborate on real-time updates, ensuring accurate financial management across teams. Integrating accounting software with systems like payroll automation or inventory tracking enables seamless workflows, reducing processing time and minimizing discrepancies.

12. ERP Systems

ERP systems such as SAP, Oracle NetSuite, and Microsoft Dynamics are indispensable for accountants managing large-scale operations. These platforms allow the consolidation of financial data from multiple departments, simplifying the preparation of accurate and comprehensive financial statements. Mastery of SAP FICO enables accountants to track and analyze multinational financial operations while maintaining compliance with international standards.

13. Digital Ledger Technologies (Blockchain)

Blockchain technology offers unparalleled security and transparency in financial transactions, making it a game-changer for accountants. Accountants can use blockchain to create immutable audit trails, ensuring compliance with international financial regulations. For instance, blockchain can record every transaction in a decentralized ledger, eliminating the risk of tampering and enhancing trust in financial reporting processes.

14. AI & Automation Tools

Artificial intelligence (AI) and robotic process automation (RPA) tools are revolutionizing repetitive accounting tasks, such as categorizing expenses, reconciling accounts, and processing large volumes of transactional data. Tools like UiPath and Automation Anywhere enable accountants to automate workflows, significantly improving speed and accuracy. Predictive analytics powered by AI helps accountants identify patterns and forecast financial outcomes.

For example, AI-driven systems can detect fraudulent activity by analyzing irregularities in transaction data, providing instant alerts for further investigation.

Functional Skills for Accountants

Functional skills refer to the specialized capabilities that accountants need to execute strategic financial tasks. Functional skills will play a pivotal role as accountants navigate complex regulatory environments, adapt to global market changes, and address emerging financial risks. Accountants with strong functional expertise will be able to assess financial risks, implement robust internal controls, and provide actionable insights to drive business decisions.

These competencies are critical for ensuring compliance, protecting organizational assets, and aligning financial strategies with long-term business goals.

15. Risk Assessment

The ability to identify, analyze, and prioritize financial risks is essential for safeguarding organizational stability. Accountants must understand tools and methodologies like risk matrices and scenario analysis to evaluate credit, market, and operational risks effectively. For instance, conducting stress tests to predict the financial impact of economic downturns allows organizations to develop mitigation strategies and strengthen resilience.

16. Regulatory Knowledge

Proficiency in local and international regulatory frameworks is non-negotiable for ensuring compliance. Accountants must stay updated on evolving standards such as IFRS, GAAP, and tax laws, as well as industry-specific regulations. Expertise in compliance reporting tools and audit trails will enable accountants to meet statutory obligations seamlessly. This ensures transparency and accountability in financial reporting through adherence to Sarbanes-Oxley (SOX) compliance requirements.

17. Strategic Thinking

Strategic thinking involves aligning financial activities with broader organizational goals to drive long-term success. Accountants with this skill can evaluate financial scenarios, allocate resources efficiently, and support decision-making at the executive level. For instance, leveraging financial forecasts to recommend capital investment strategies can position the organization for sustained growth.

18. Internal Controls

Implementing and monitoring internal controls is essential for safeguarding organizational assets and preventing fraud. Accountants must design and evaluate control systems, such as segregation of duties and access restrictions, to ensure operational integrity. By auditing internal processes to identify control weaknesses, accountants can mitigate risks and enhance compliance with corporate governance standards.

19. Financial Analysis

Financial analysis involves interpreting data to assess organizational performance and make informed recommendations. Accountants must be proficient in tools like Excel, Power BI, and Tableau to analyze financial statements, track key metrics, and identify trends. For example, conducting profitability analysis to evaluate product lines or market segments allows organizations to focus on high-performing areas and improve efficiency.

Cross-Departmental Skills for Accountants

Cross-departmental skills refer to the abilities that enable accountants to collaborate effectively across various teams and align financial strategies with broader organizational objectives. Accountants will increasingly serve as strategic partners, bridging the gap between finance and other departments. As organizations adopt more integrated approaches to decision-making, accountants must work closely with teams from operations, marketing, and technology.

Cross-departmental skills empower accountants to contribute to company-wide initiatives, adapt to change, and ensure that financial perspectives are seamlessly integrated into broader business strategies.

20. Business Acumen

Business acumen equips accountants with the ability to evaluate the financial impact of strategic decisions, ensuring they align with organizational goals. For example, an accountant with strong business acumen can collaborate with marketing teams to allocate advertising budgets effectively, using financial data to assess campaign costs, forecast potential revenue, and calculate return on investment.

This skill allows accountants to identify profitable opportunities, minimize financial risks, and provide actionable insights that guide resource allocation and maximize profitability. Accountants also use this expertise to support leadership in evaluating new business ventures, mergers, or product launches, ensuring every decision is financially sound and aligned with the company’s overall strategy.

21. Collaboration & Teamwork

Effective teamwork and communication are essential for accountants working with cross-functional teams. This involves sharing financial insights, aligning on objectives, and ensuring smooth execution of joint projects. For instance, accountants might collaborate with IT teams to implement ERP systems or with operations to identify cost-saving opportunities, fostering a cohesive approach to organizational goals.

22. Change Management

With rapid technological advancements and evolving business environments, change management skills are critical for accountants in navigating and guiding organizations through transitions. Accountants play a key role in assessing the financial implications of restructures, mergers, or the implementation of new technologies.

This involves analyzing the costs and benefits of proposed changes, ensuring continuity in financial processes, and aligning transitions with overall business objectives. Successfully transitioning an organization to a new accounting platform, for instance, requires accountants to maintain data accuracy, ensure compliance, and minimize disruptions, demonstrating their ability to manage change effectively.

23. Digital Literacy

Digital skills for accountants are essential in today's technology-driven accounting landscape. These include proficiency in accounting software and data analytics tools, enabling precise and efficient performance of responsibilities. Leveraging AI, accountants can streamline routine tasks, enhancing both accuracy and productivity.

By automating data entry, categorizing expenses, and reconciling accounts, AI tools reduce the risk of errors and allow accountants to focus on strategic, high-value activities. With predictive models, you analyze historical data to forecast cash flows and identify trends, offering insights for financial planning. Also, machine learning models help detect fraud by flagging unusual transactions.

5 Popular Frameworks Used by Accountants in 2026

In 2026, accountants and finance professionals are increasingly adopting diverse frameworks and models that go beyond traditional financial reporting to address sustainability, governance, and long-term value creation. This table highlights five popular frameworks used by accountants today, each offering unique advantages.

From the globally recognized International Financial Reporting Standards (IFRS) to the Environmental, Social, and Governance (ESG) reporting standards, these frameworks are essential for companies aiming to provide transparent, standardized, and socially responsible reporting. The examples included illustrate how leading organizations are leveraging these frameworks to meet regulatory requirements, attract investors, and foster trust among stakeholders.

T-Shaped Skill Development Model for Competitive Accountants

The T-shaped model is a framework for skill development that balances both breadth (general knowledge) and depth (specialized expertise). The model helps professionals become versatile and collaborative while deepening expertise in their specific field.

For accountants, adopting a T-shaped approach allows you to broaden your impact in the industry by acquiring a mix of technical skills and soft skills crucial for cross-functional collaboration and client relations.

Applying the T-Shaped Model in Accounting Skills Development

1. Horizontal Axis: Broadening Knowledge

The horizontal line of the T represents a wide range of knowledge across various fields that complement core your accounting skills. It may include learning the basics of financial technology, understanding regulatory changes, gaining an intuitive grasp of data analysis, and familiarizing yourself with project management concepts. Having a broad knowledge base allows you to adapt to meet the changing needs of accounting.

2. Vertical Axis: Deepening Expertise

The vertical line of the T symbolizes specialized knowledge. Accountants typically excel in areas like tax law, auditing, and financial reporting. By focusing on developing deep expertise in one or more of these areas, accountants can add significant value to their clients and organizations. You can further enhance your expertise by specializing in areas like forensic accounting or international tax law, setting yourself apart in the field.

Forensic accounting skills allow you to detect and investigate financial fraud, making you an invaluable asset in today’s increasingly complex financial landscape. Specializing in international tax law, on the other hand, empowers you to navigate cross-border regulations, helping clients manage tax obligations and optimize global strategies.

3. Developing Key Soft Skills for Interdisciplinary Collaboration

Soft skills fall on the horizontal line of the T-shape, and encourage building strong interpersonal and communication skills. Soft skills such as teamwork, empathy, and effective communication are essential for working with other departments, translating complex financial concepts for non-experts, and fostering strong client relationships. Through soft skill development, accountants can play a proactive role in strategic business discussions, offering insights that go beyond numbers.

Persisting Towards Professional Excellence: An Accountant’s Journey to Success

Nikita, Vice President, and Audit Manager at Truist, demonstrated a strong work ethic by balancing multiple part-time jobs while pursuing her education. She immersed herself in the field, earning a Bachelor of Science in Accounting with a minor in Finance, followed by a Master of Business Administration with a concentration in Accounting and Information Technology.

Her dedication to mastering the complexities of accounting was evident as she navigated the rigorous requirements to become a Certified Public Accountant (CPA), taking on 18 credit hours per semester and managing the demands of working multiple jobs.

Nikita's commitment to professional development was further tested as she tackled the challenging CPA exams, enduring over twenty attempts and significant financial investments to finally achieve certification. Her relentless pursuit of knowledge and excellence, despite personal and financial hardships, exemplifies the essence of continuous learning.

By leveraging her strong mathematical skills and passion for helping others, Nikita not only succeeded in becoming the first CPA in her family but also set a powerful example of perseverance and dedication for aspiring accountants. Her journey underscores the importance of unwavering commitment to overcome obstacles to achieve professional goals.

Final Thoughts

In the future, accountants will need a well-rounded skill set to excel in a dynamic industry driven by technology and data. Key skills like digital literacy, business intelligence, and data analysis will enhance productivity. The shift toward progressive learning and strategic thinking will prepare accountants to handle evolving challenges.

The T-shaped skill model encourages a blend of technical depth and broad knowledge, making accountants more adaptable and valuable. Success stories like Nikita’s demonstrate the importance of perseverance and continuous learning in achieving professional goals.

Ready to boost your skills? Explore our training materials at Edstellar to stay competitive in the dynamic finance world.

Frequently Asked Questions

🔗 Continue Reading

Explore High-impact instructor-led training for your teams.

#On-site #Virtual #GroupTraining #Customized

Bridge the Gap Between Learning & Performance

Turn Your Training Programs Into Revenue Drivers.

Schedule a ConsultationEdstellar Training Catalog

Explore 2000+ industry ready instructor-led training programs.

Coaching that Unlocks Potential

Create dynamic leaders and cohesive teams. Learn more now!

Want to evaluate your team’s skill gaps?

Do a quick Skill gap analysis with Edstellar’s Free Skill Matrix tool

Transform Your L&D Strategy Today

Unlock premium resources, tools, and frameworks designed for HR and learning professionals. Our L&D Hub gives you everything needed to elevate your organization's training approach.

Access L&D Hub Resources.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)