Corporate Financial Crime Prevention Training Course

Edstellar's instructor-led Financial Crime Prevention training course empowers teams with skills to detect, deter, and mitigate illicit activities within the financial system. Protect your organization with tools from risk assessment to compliance management. Elevate your team's capabilities with advanced Financial Crime Prevention training.

(Virtual / On-site / Off-site)

Available Languages

English, Español, 普通话, Deutsch, العربية, Português, हिंदी, Français, 日本語 and Italiano

Drive Team Excellence with Financial Crime Prevention Corporate Training

Empower your teams with expert-led on-site/in-house or virtual/online Financial Crime Prevention Training through Edstellar, a premier Financial Crime Prevention training company for organizations globally. Our customized training program equips your employees with the skills, knowledge, and cutting-edge tools needed for success. Designed to meet your specific training needs, this Financial Crime Prevention group training program ensures your team is primed to drive your business goals. Transform your workforce into a beacon of productivity and efficiency.

Financial Crime Prevention training educates employees about recognizing and preventing various financial crimes like fraud, money laundering, and bribery. It equips them with the knowledge and tools to protect the organization's financial assets and comply with regulations. This course is an investment that safeguards your organization's financial health and builds a culture of compliance.

Edstellar's instructor-led Financial Crime Prevention training course is designed to address the needs through virtual/onsite sessions led by industry experts with years of experience. The course offers a customized curriculum that combines theoretical knowledge with practical exercises, ensuring that professionals can apply what they learn directly to their work.

Key Skills Employees Gain from Financial Crime Prevention Training

Financial Crime Prevention skills corporate training will enable teams to effectively apply their learnings at work.

- Fraud DetectionFraud Detection is the ability to identify and prevent fraudulent activities through data analysis and pattern recognition. This skill is important for roles in finance, security, and compliance, as it safeguards assets and maintains trust.

- Risk AssessmentRisk Assessment is the process of identifying, analyzing, and evaluating potential risks in a project or organization. This skill is important for roles in project management, finance, and compliance, as it helps mitigate threats, ensure safety, and enhance decision-making.

- Investigation TechniquesInvestigation Techniques involve systematic methods for gathering, analyzing, and interpreting data. This skill is important for roles in law enforcement, cybersecurity, and compliance, ensuring thorough and effective problem-solving.

- Anti-Money Laundering (AML)Anti-Money Laundering (AML) involves detecting and preventing illicit financial activities. this skill is important for compliance officers and financial analysts to safeguard institutions against legal risks and maintain integrity.

- Transaction MonitoringTransaction Monitoring is the process of analyzing financial transactions to detect suspicious activities and prevent fraud. This skill is important for compliance officers and financial analysts to ensure regulatory adherence and protect against financial crimes.

- Suspicious Activity ReportingSuspicious Activity Reporting involves identifying and documenting unusual transactions. This skill is important for compliance roles in finance to prevent fraud and ensure regulatory adherence.

Key Learning Outcomes of Financial Crime Prevention Training Workshop for Employees

Edstellar’s Financial Crime Prevention training for employees will not only help your teams to acquire fundamental skills but also attain invaluable learning outcomes, enhancing their proficiency and enabling application of knowledge in a professional environment. By completing our Financial Crime Prevention workshop, teams will to master essential Financial Crime Prevention and also focus on introducing key concepts and principles related to Financial Crime Prevention at work.

Employees who complete Financial Crime Prevention training will be able to:

- Analyze financial data and transactions to detect anomalies indicative of potential financial crimes

- Apply comprehensive financial crime prevention strategies to safeguard organizational assets and ensure regulatory compliance

- Develop and implement effective anti-money laundering (AML) and counter-financing of terrorism (CFT) policies and procedures

- Integrate ethical decision-making processes in handling financial crime incidents, promoting a culture of integrity and compliance

- Design and execute training programs for staff at all levels, enhancing organizational awareness and resilience against financial crimes

Key Benefits of the Financial Crime Prevention Group Training

Attending our Financial Crime Prevention classes tailored for corporations offers numerous advantages. Through our Financial Crime Prevention group training classes, participants will gain confidence and comprehensive insights, enhance their skills, and gain a deeper understanding of Financial Crime Prevention.

- Learn to navigate and apply the latest regulations and compliance standards in financial crime prevention

- Explore innovative technologies and methodologies for enhancing the organization’s financial crime prevention efforts

- Equip professionals with advanced analytical skills to identify and assess the risk of financial crimes within the organization

- Develop comprehensive strategies for mitigating the risk of financial crimes, including fraud, money laundering, and bribery

- Equip the team with the knowledge to conduct thorough investigations into suspected financial crimes, ensuring due diligence and compliance

Topics and Outline of Financial Crime Prevention Training

Our virtual and on-premise Financial Crime Prevention training curriculum is divided into multiple modules designed by industry experts. This Financial Crime Prevention training for organizations provides an interactive learning experience focused on the dynamic demands of the field, making it relevant and practical.

- Transnational organized crime

- Definition and characteristics

- Global impact and networks

- Interpol's 18 crime areas

- Overview of Interpol's mandate

- Detailed description of crime areas

- Interpol's role in combating financial crime

- Global response: the AML regime

- Introduction to AML (Anti-Money Laundering)

- Key components and regulations

- International cooperation efforts

- Terrorist financing and sanctions

- Mechanisms of terrorist financing

- Sanctions regimes and enforcement

- Counter-terrorism measures

- UNTOC (United Nations Convention against Transnational Organized Crime)

- Objectives and scope

- Implementation and challenges

- Impact on global crime prevention

- FATF (Financial Action Task Force)

- Role and functions

- Recommendations and standards

- Compliance and evaluation processes

- The Egmont group

- Information sharing among FIUs (Financial Intelligence Units)

- Collaboration and success stories

- Challenges and future directions

- The role of FIUs (Financial Intelligence Units)

- Functions and responsibilities

- Case studies highlighting successes

- Collaboration with law enforcement agencies

- The private sector: gatekeepers

- Responsibilities of financial institutions

- Regulatory compliance and due diligence

- Importance of private sector cooperation

- The rationale for reporting

- Legal and ethical obligations

- Importance of reporting suspicious transactions

- Impact on financial crime prevention

- The role of financial intelligence

- Sources and utilization of financial intelligence

- Practical applications in investigations

- FCC as the tool to protect the financial system's integrity

- Introduction to Financial Crime Compliance (FCC)

- Implementation and challenges

- ABC essentials explained

- Definition and types of bribery and corruption

- Consequences and impacts

- Regulatory frameworks

- UKBA 2010 (UK Bribery Act 2010)

- Overview and key provisions

- Compliance requirements

- Anti-bribery & corruption videos

- Educational resources and case studies

- Role of training in prevention

- Whistleblowing and reporting mechanisms

- Whistleblowing

- Importance and protections

- Reporting mechanisms

- FCA (Financial Conduct Authority)

- Role in combating bribery and corruption

- Regulatory oversight and enforcement actions

- Collaboration with other agencies

- OECD (Organization for Economic Cooperation and Development)

- Anti-bribery convention and guidelines

- Monitoring and compliance mechanisms

- Global impact and initiatives

- UNCAC (United Nations Convention against Corruption)

- Objectives and scope

- Implementation challenges

- Global efforts to combat corruption

- Stolen Asset Recovery Initiative (StAR)

- Overview and objectives

- Strategies for asset recovery

- StAR cases

- Notable cases and success stories

- Challenges

- Future directions for asset recovery

- SFO cases (Serious Fraud Office)

- Overview and mandate

- Notable investigations and prosecutions

- Impact on corporate governance

- Proceeds of crime

- Definition and types of criminal proceeds

- Methods of laundering illicit funds

- The three-stage ML process

- Placement, layering, and integration stages

- Techniques used at each stage

- Detection and prevention strategies

- ML vulnerability: the zero point

- Understanding vulnerabilities in the financial system

- Identifying weaknesses in AML procedures

- Mitigation strategies for zero-point vulnerabilities

- Basel AML Index

- Overview and purpose of the index

- Methodology and indicators used

- Implications for AML policies

- Offenses

- Overview of money laundering offenses

- Legal framework and penalties

- The 4th MLD (Fourth Money Laundering Directive)

- Key provisions and requirements

- Impact on financial institutions

- Compliance challenges

- Triggering the AML investigation

- Identifying suspicious transactions and activities

- Reporting procedures and protocols

- Collaboration with law enforcement agencies

- From suspicion to reporting

- Steps involved in assessing suspicious activity

- Decision-making processes for reporting

- Legal and ethical considerations

- SAR and the good "narrative"

- Structure and content of suspicious activity reports (SARs)

- Importance of providing a detailed narrative

- Role of SARs in AML investigations

- SAR simulation exercise: lodging SARs to the NCA

- Simulated scenarios

- Feedback and evaluation of SAR submissions

- Phishing

- Techniques used in phishing attacks

- Prevention strategies for individuals and organizations

- Webcam manager

- Risks associated with webcam hacking

- Protection measures for webcam security

- File hijacking

- Methods employed in file hijacking attacks

- Impact on individuals and organizations

- Techniques to prevent and respond to file hijacking

- Keylogging

- Functionality and purposes of keyloggers

- Detection and removal of keylogging software

- Screenshot manager

- Risks of unauthorized screenshot capture

- Safeguarding against screenshot theft

- Incidents of screenshot abuse in cybercrime

- Ad clicker

- Operation and consequences of ad clicker malware

- Detection and mitigation strategies

- Examples of ad clicker attacks and damage

- Hacking

- Types of hacking techniques and methods

- Vulnerabilities exploited by hackers

- Distributed denial of service (DDOS)

- Mechanics and goals of DDOS attacks

- Defenses and mitigation techniques

- Notable DDOS incidents and their impact

- JMLIT (Joint Money Laundering Intelligence Taskforce)

- Purpose and objectives of JMLIT

- Collaboration between government agencies and financial institutions

- Outcomes of JMLIT initiatives

- European Cybercrime Centre (EC3)

- Role and functions of EC3

- Cooperation with EU member states and international partners

- Initiatives and campaigns to combat cybercrime

- Information assurance and cyber security for information asset and information risk owners

- Importance of information assurance and cyber security

- Responsibilities of information asset owners

- Risk management strategies for protecting information assets

- Identity crime

- Types of identity theft and fraud

- Detection and prevention measures

- Impact on individuals and organizations

- Individual fraud

- Common types of individual fraud schemes

- Red flags and warning signs

- Reporting and response procedures

- Corporate fraud

- Forms of corporate fraudulent activities

- Internal controls and fraud prevention measures

- Online fraud

- Overview of online fraud techniques

- E-commerce fraud prevention strategies

- Legal and regulatory frameworks for online transactions

- Advanced fee fraud

- Characteristics and methods of advanced fee fraud

- Recognizing and avoiding advance fee scams

- Tax and benefit system fraud

- Types of fraudulent activities in tax and benefit systems

- Detection and investigation techniques

- Collaboration with tax authorities and government agencies

- Intellectual property crime

- Forms of intellectual property theft and fraud

- Protecting intellectual property rights

- Legal remedies for intellectual property violations

- Insider dealing

- Definition and types of insider dealing

- Regulatory compliance requirements

- Detection and enforcement measures

Who Can Take the Financial Crime Prevention Training Course

The Financial Crime Prevention training program can also be taken by professionals at various levels in the organization.

- Compliance Officers

- Fraud Analysts

- AML Analysts

- Risk Analysts

- Financial Investigators

- Internal Auditors

- Security Analysts

- Legal Analysts

- Forensic Accountants

- Financial Crime Analysts

- KYC Analysts

- Managers

Prerequisites for Financial Crime Prevention Training

There are no specific prerequisites for Financial Crime Prevention training training. However, having a basic understanding of financial statements and markets is beneficial.

Corporate Group Training Delivery Modes

for Financial Crime Prevention Training

At Edstellar, we understand the importance of impactful and engaging training for employees. As a leading Financial Crime Prevention training provider, we ensure the training is more interactive by offering Face-to-Face onsite/in-house or virtual/online sessions for companies. This approach has proven to be effective, outcome-oriented, and produces a well-rounded training experience for your teams.

.webp)

Edstellar's Financial Crime Prevention virtual/online training sessions bring expert-led, high-quality training to your teams anywhere, ensuring consistency and seamless integration into their schedules.

.webp)

Edstellar's Financial Crime Prevention inhouse training delivers immersive and insightful learning experiences right in the comfort of your office.

.webp)

Edstellar's Financial Crime Prevention offsite group training offer a unique opportunity for teams to immerse themselves in focused and dynamic learning environments away from their usual workplace distractions.

Explore Our Customized Pricing Package

for

Financial Crime Prevention Corporate Training

Need the cost or quote for onsite, in-house, or virtual instructor-led corporate Financial Crime Prevention training? Get a customized proposal that fits your team's specific needs.

64 hours of training (includes VILT/In-person On-site)

Tailored for SMBs

Tailor-Made Licenses with Our Exclusive Training Packages!

160 hours of training (includes VILT/In-person On-site)

Ideal for growing SMBs

400 hours of training (includes VILT/In-person On-site)

Designed for large corporations

Unlimited duration

Designed for large corporations

Edstellar: Your Go-to Financial Crime Prevention Training Company

Experienced Trainers

Our trainers bring years of industry expertise to ensure the training is practical and impactful.

Quality Training

With a strong track record of delivering training worldwide, Edstellar maintains its reputation for its quality and training engagement.

Industry-Relevant Curriculum

Our course is designed by experts and is tailored to meet the demands of the current industry.

Customizable Training

Our course can be customized to meet the unique needs and goals of your organization.

Comprehensive Support

We provide pre and post training support to your organization to ensure a complete learning experience.

Multilingual Training Capabilities

We offer training in multiple languages to cater to diverse and global teams.

What Our Clients Say

We pride ourselves on delivering exceptional training solutions. Here's what our clients have to say about their experiences with Edstellar.

"Edstellar's IT Service Management training has been transformative. Our IT teams have seen significant improvements through multiple courses delivered at our office by expert trainers. Excellent feedback has prompted us to extend the training to other teams."

"Edstellar's quality and process improvement training courses have been fantastic for our team of quality engineers, process engineers and production managers. It’s helped us improve quality and streamline manufacturing processes. Looking ahead, we’re excited about taking advanced courses in quality management, and project management, to keep improving in the upcoming months."

"Partnering with Edstellar for web development training was crucial for our project requirements. The training has equipped our developers with the necessary skills to excel in these technologies. We're excited about the improved productivity and quality in our projects and plan to continue with advanced courses."

"Partnering with Edstellar for onsite ITSM training courses was transformative. The training was taken by around 80 IT service managers, project managers, and operations managers, over 6 months. This has significantly improved our service delivery and standardized our processes. We’ve planned the future training sessions with the company."

"Partnering with Edstellar for onsite training has made a major impact on our team. Our team, including quality assurance, customer support, and finance professionals have greatly benefited. We've completed three training sessions, and Edstellar has proven to be a reliable training partner. We're excited for future sessions."

"Edstellar's online training on quality management was excellent for our quality engineers and plant managers. The scheduling and coordination of training sessions was smooth. The skills gained have been successfully implemented at our plant, enhancing our operations. We're looking forward to future training sessions."

"Edstellar's online AI and Robotics training was fantastic for our 15 engineers and technical specialists. The expert trainers and flexible scheduling across different time zones were perfect for our global team. We're thrilled with the results and look forward to future sessions."

"Edstellar's onsite process improvement training was fantastic for our team of 20 members, including managers from manufacturing, and supply chain management. The innovative approach, and comprehensive case studies with real-life examples were highly appreciated. We're excited about the skills gained and look forward to future training."

"Edstellar's professional development training courses were fantastic for our 50+ team members, including developers, project managers, and consultants. The multiple online sessions delivered over several months were well-coordinated, and the trainer's methodologies were highly effective. We're excited to continue our annual training with Edstellar."

"Edstellar's IT service management training for our 30 team members, including IT managers, support staff, and network engineers, was outstanding. The onsite sessions conducted over three months were well-organized, and it helped our team take the exams. We are happy about the training and look forward to future collaborations."

"Edstellar's office productivity training for our 40+ executives, including project managers and business analysts, was exceptional. The onsite sessions were well-organized, teaching effective tool use with practical approaches and relevant case studies. Everyone was delighted with the training, and we're eager for more future sessions."

"Edstellar's quality management training over 8 months for our 15+ engineers and quality control specialists was outstanding. The courses addressed our need for improved diagnostic solutions, and the online sessions were well-organized and effectively managed. We're thrilled with the results and look forward to more."

"Edstellar's digital marketing training for our small team of 10, including content writers, SEO analysts, and digital marketers, was exactly what we needed. The courses delivered over a few months addressed our SEO needs, and the online sessions were well-managed. We're very happy with the results and look forward to more."

"Edstellar's telecommunications training was perfect for our small team of 12 network engineers and system architects. The multiple online courses delivered over a few months addressed our needs for network optimization and cloud deployment. The training was well-managed, and the case studies were very insightful. We're thrilled with the outcome."

"Edstellar's professional development training was fantastic for our 50+ participants, including team leaders, analysts, and support staff. Over several months, multiple courses were well-managed and delivered as per the plan. The trainers effectively explained topics with insightful case studies and exercises. We're happy with the training and look forward to more."

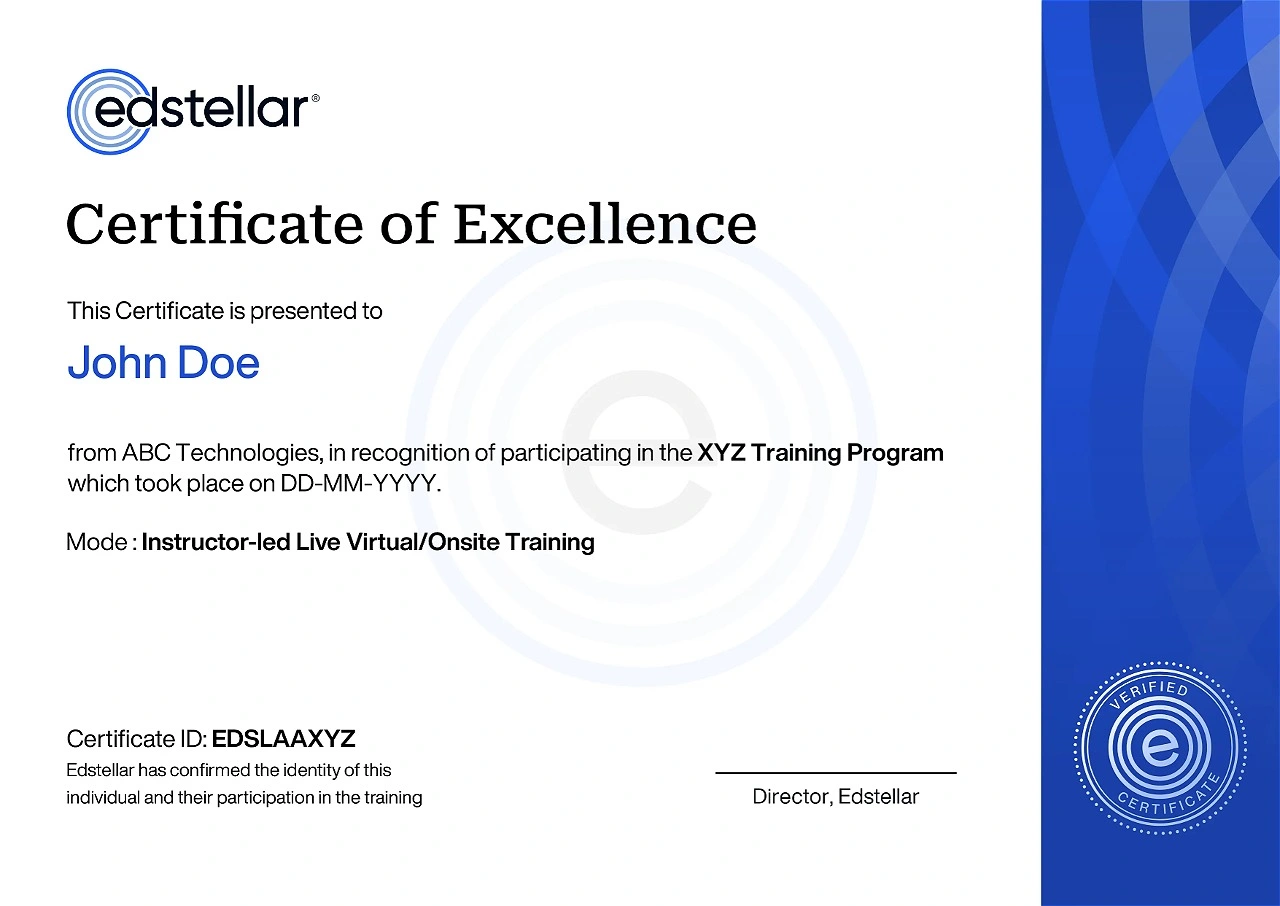

Get Your Team Members Recognized with Edstellar’s Course Certificate

Upon successful completion of the Financial Crime Prevention training course offered by Edstellar, employees receive a course completion certificate, symbolizing their dedication to ongoing learning and professional development.

This certificate validates the employee's acquired skills and is a powerful motivator, inspiring them to enhance their expertise further and contribute effectively to organizational success.

We have Expert Trainers to Meet Your Financial Crime Prevention Training Needs

The instructor-led training is conducted by certified trainers with extensive expertise in the field. Participants will benefit from the instructor's vast knowledge, gaining valuable insights and practical skills essential for success in Access practices.

.svg)

.svg)

.svg)

.svg)