Consumption Tax skills corporate training will enable teams to effectively apply their learnings at work.

- Tax Analysts

- Tax Advisors

- VAT Coordinators

- Tax Compliance Officers

- Corporate Tax Advisors

- Revenue Officers

- Senior Accountants

- Tax Accountants

- Audit Associates

- Tax Managers

- VAT Managers

- Indirect Tax Managers

64 hours of training (includes VILT/In-person On-site)

Tailored for SMBs

160 hours of training (includes VILT/In-person On-site)

Ideal for growing SMBs

400 hours of training (includes VILT/In-person On-site)

Designed for large corporations

Unlimited duration

Designed for large corporations

Experienced Trainers

Our trainers bring years of industry expertise to ensure the training is practical and impactful.

Quality Training

With a strong track record of delivering training worldwide, Edstellar maintains its reputation for its quality and training engagement.

Industry-Relevant Curriculum

Our course is designed by experts and is tailored to meet the demands of the current industry.

Customizable Training

Our course can be customized to meet the unique needs and goals of your organization.

Comprehensive Support

We provide pre and post training support to your organization to ensure a complete learning experience.

Multilingual Training Capabilities

We offer training in multiple languages to cater to diverse and global teams.

What Our Clients Say

We pride ourselves on delivering exceptional training solutions. Here's what our clients have to say about their experiences with Edstellar.

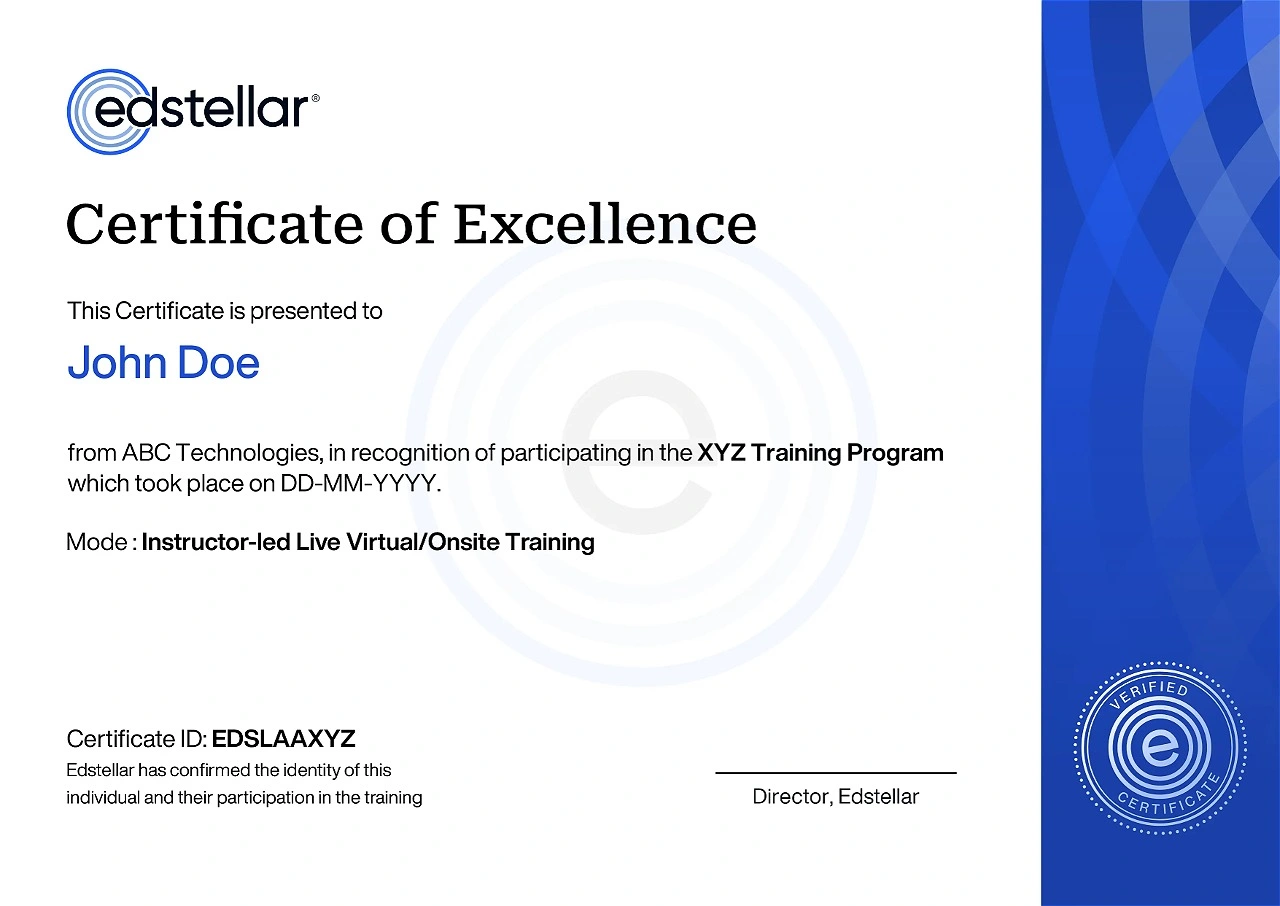

Get Your Team Members Recognized with Edstellar’s Course Certificate

.svg)

.webp)

.webp)

.webp)

.svg)

.svg)

.svg)